UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

☑ | Filed by the Registrant | o | Filed by a Party other than the Registrant |

Check the appropriate box: | |

o | Preliminary Proxy Statement |

o | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY |

☑ | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Under Rule 14a-12 |

South Jersey Industries, Inc. |

(Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

Payment of Filing Fee (Check the appropriate box): | ||

☑ | No fee required. | |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

(1) | Title of each class of securities to which transaction applies: | |

(2) | Aggregate number of securities to which transaction applies: | |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: | |

(4) | Proposed maximum aggregate value of transaction: | |

(5) | Total fee paid: | |

o | Fee paid previously with preliminary materials. | |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

(1) | Amount Previously Paid: | |

(2) | Form, Schedule or Registration Statement No.: | |

(3) | Filing Party: | |

(4) | Date Filed: | |

| South Jersey Industries, Inc. 1 South Jersey Plaza Folsom, New Jersey 08037 Tel. (609) 561-9000 Fax (609) 561-7130 |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

DATE: | April |

TIME: | 9:00 a.m. |

PLACE: | |

ONLINE: | www.virtualshareholdermeeting.com/SJI2020 |

To the Shareholders of South Jersey Industries

NOTICE IS HEREBY GIVEN that South Jersey Industries, Inc.’s (“Company” or “SJI”) 2020 Annual Meeting of Shareholders (the “Annual Meeting”) will be held at Hard Rock Hotel & Casino Atlantic City, BrightonThe Westin Mount Laurel, The Grand Ballroom, 1000 Boardwalk, Atlantic City, New Jersey 08401555 Fellowship Road, Mount Laurel, ,NJ 08054and online at: www.virtualshareholdermeeting.com/SJI2020 on April 26, 2019,24, 2020, at 9:00 a.m., Eastern Time, for the following purposes:

| 1. | To elect 10 director nominees who are |

| 2. | To hold an advisory vote to approve executive compensation |

| 3. | To ratify the appointment of Deloitte & Touche LLP as the independent registered public accounting firm for |

| 4. | To transact other business that may properly come before the |

Voting can be completed in one of | |||||

| returning the proxy card by mail |  | online at www.proxyvote.com |  | Attend the meeting online at: www.virtualshareholdermeeting.com/SJI2020 |

| through the telephone at 1-800-690-6903 |  | attending the meeting to vote IN PERSON | ||

The Board of Directors has fixed the close of business on February 25, 201924, 2020 as the record date (the “Record Date”) for determining shareholders entitled to notice of, and to vote at, the Annual Meeting. Accordingly, only shareholders of record on that date are entitled to notice of, and to vote at, the meeting.Annual Meeting.

You are cordially invited to attend the meeting.meeting in person or online meeting at: www.virtualshareholdermeeting.com/SJI2020. Attendance at the Annual Meeting will be limited to shareholders as of therecord date, Record Date, their authorized representatives and guests of SJI. Guests of shareholders will not be admitted unless they arealso shareholders as of the record date.Record Date. If you plan to attend the meetingAnnual Meeting in person, you will need an admission ticket and a valid government issued photo ID to enter the meeting. Annual Meeting. For shareholders of record, an admission ticket is attached to your proxy card. If your shares are held in the name of a bank, broker or other holder of record, please bring your account statement as that will serve as your ticket.

Although we intend to hold our annual meeting in person, we are sensitive to the public health and travel concerns our shareholders may have and the protocols that federal, state, and local governments may impose. In the event it is not possible or advisable to attend our annual meeting in person, we encourage you to attend online at www.virtualshareholdermeeting.com/SJI2020. If you attend online, you will be able to vote your shares and submit questions by following the instructions on the website. We reserve the right to convert to a virtual only meeting format should meeting in person become unsafe as a result of COVID-19. If we convert to a virtual only online meeting we will post a notification at www.sjindustries.com as soon as possible.

Whether or not you expect to attend the meeting,Annual Meeting, we urge you to vote your shares now. Please complete and sign the enclosed proxy card and promptly return it in the envelope provided or, if you prefer, you may vote by telephone or on the Internet. Please refer to the enclosed proxy card for instructions on how to use these options. Should you attend the meeting,Annual Meeting, you may revoke your proxy and vote in person.

BY ORDER OF THE BOARD OF DIRECTORS

Corporate Secretary

Folsom, NJ

March 15, 201913, 2020

YOUR VOTE IS IMPORTANT. PLEASE VOTE, SIGN, DATE, AND PROMPTLY RETURN YOUR PROXY IN THE ENCLOSED ENVELOPE OR VOTE BY TELEPHONE OR ON THE INTERNET.

Important Notice Regarding the Availability of Proxy Materials for the Shareholders Meeting to be Held on April 26, 2019.24, 2020. The Proxy Statement, the Proxy Card and the 20182019 Annual Report are also available to view at www.sjindustries.com by clicking on Investors > Financial ReportingReporting.

This summary highlights information contained elsewhere in this proxy statement.Proxy Statement. This summary does not contain all the information you should consider, and you should read the entire proxy statementProxy Statement carefully before voting.

Annual Meeting of Shareholders

Date: | April | |

Time: | ||

9:00 a.m. - meeting begins | ||

10:00 a.m. - meeting adjourns | ||

Place: | The Westin Mount Laurel | |

Mount Laurel, New Jersey | ||

Online: | www.virtualshareholdermeeting.com/SJI2020 | |

Admission to the meeting: | Attendance at the Annual Meeting will be limited to shareholders as of the | |

Although we intend to hold our annual meeting in person, we are sensitive to the public health and travel concerns our shareholders may have and the protocols that federal, state, and local governments may impose. In the event it is not possible or advisable to attend our annual meeting in person, we encourage you to attend online at www.virtualshareholdermeeting.com/SJI2020. If you attend online, you will be able to vote your shares and submit questions by following the instructions on the website. We reserve the right to convert to a virtual only meeting format should meeting in person become unsafe as a result of COVID-19. If we convert to a virtual only online meeting we will post a notification at sjindustries.com as soon as possible. Use of cameras, recording devices, computers, and other electronic devices, such as smartphones and tablets, will not be permitted at the Annual Meeting. Photography and video are prohibited at the Annual Meeting. Photographs taken by South Jersey Industries at the | ||

Record Date: | February | |

Agenda: | • | Election of 10 |

• | ||

• | Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for | |

• | Transaction of any other business that may properly come before the meeting | |

Voting: | Shareholders as of the | |

Voting Matters and the Board’s Recommendation

The following table summarizes the items that will be brought for a vote of our stockholdersshareholders at the meeting, along with the Board’s recommendation as to how shareholders should vote on each of them.

Proposal No. | Description of Proposal | Board’s Recommendation |

1 | Election of 10 director candidates nominated by the Board, each to serve a one-year term | FOR |

2 | FOR | |

3 | Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for | FOR |

In addition to these matters, shareholders may be asked to vote on such other business as may properly be brought before the meeting or any adjournment or postponement of the meeting.thereof.

South Jersey Industries, Inc. - | 1 |

Proxy Statement Summary

The table below summarizes the votes required for approval of each matter to be brought before the annual meeting,Annual Meeting, as well as the treatment of abstentions and broker non-votes.

Proposal No. | Description of Proposal | Vote Required for Approval | Abstentions | Broker Non-Votes |

1 | Election of directors | Majority of votes cast | No effect | Not taken into account |

2 | Executive compensation | Majority of votes cast | No effect | Not taken into account |

3 | Ratification of independent registered public accounting firm | Majority of votes cast | No effect | Not applicable |

The Board is currently comprised of 10 directors: 9 independent directors; and SJI President and Chief Executive Officer. The following table provides summary information about each of the 10 director nominees, including whether the Board considers the

nominee to be independent under the New York Stock Exchange’s independence standards and SJI Corporate Governance Guidelines. Each director is elected annually by a majority of votes cast.

Name | Age | Director Since | Occupation | Independent | Positions/Committee Memberships |

Sarah M. Barpoulis | 54 | 2012 | Owner of Interim Energy Solutions, LLC | Yes | 1*, 2, 3, 7 |

Thomas A. Bracken | 71 | 2004 | President, New Jersey Chamber of Commerce | Yes | 3, 4*, 5, 7 |

Keith S. Campbell | 64 | 2000 | Chairman of the Board, Mannington Mills, Inc. | Yes | 2, 5, 6 |

Victor A. Fortkiewicz | 67 | 2010 | Of Counsel, Cullen and Dykman, LLP | Yes | 4, 5*, 6 |

Sheila Hartnett-Devlin, CFA | 60 | 1999 | Retired, Senior Vice President, American Century Investments | Yes | 1, 4, 7 |

Walter M. Higgins III | 74 | 2008 | Chairman (non-executive) of South Jersey Industries | Yes | 3* As Chairman of the Board, serves as an ex-officio member of all committees |

Sunita Holzer | 57 | 2011 | Executive Vice President, Chief Human Resource Officer, Realogy Holdings Corp. | Yes | 2*, 3, 5, 6 |

Michael J. Renna | 51 | 2014 | President and CEO, South Jersey Industries | No | 3 |

Joseph M. Rigby | 62 | 2016 | Retired, Chairman, President and CEO, Pepco Holdings, Inc. | Yes | 1, 2, 7* |

Frank L. Sims | 68 | 2012 | Chairman of the Board, Atlanta Pension Fund, Retired, Corporate Vice President and Platform Leader, Cargill, Inc. | Yes | 1, 3, 4, 6* |

|  |  |  |  |

Key to Committee MembershipsWhy am I being provided with these materials?

This statement is furnished on behalf of SJI’s Board of Directors to solicit proxies for use at its 2019 Annual Meeting of Shareholders.and at any adjournments or postponements thereof. The meeting is scheduled for Friday, April 26, 2019,24, 2020, at 9:00 a.m. at Hard Rock Hotel & Casino, BrightonThe Westin Mount Laurel, 555 Fellowship Road, The Grand Ballroom, 1000 Boardwalk, Atlantic City,Mount Laurel, New

Jersey. The approximate date proxy materials will

be made available to shareholders is March 15, 2019.13, 2020. Copies of this Proxy Statement, the proxy statement, proxy card and 20182019 Annual Report are available on our website at www.sjindustries.com under the heading “Investors”.“Investors.”

Proxy Solicitation

The Company bears the cost of this solicitation, which is primarily made by mail. However, the Corporate Secretary or companyCompany employees may solicit proxies by phone, fax, e-mail or in person, but they will not be separately compensated for these services. The Company maywill also use a proxy-soliciting firmD. F. King at a cost not expected to exceed

expected to exceed $15,000,$12,500, plus expenses, to distribute to brokerage houses and other custodians, nominees, and fiduciaries additional copies of the proxy materials and 20182019 Annual Report for beneficial owners of our stock.

Record DateWho is entitled to vote?

Only shareholders of record, meaning those holders whose shares of our common stock, are registered directly with our transfer agent, Broadridge at the close of business on February 25, 201924, 2020 may vote at the meeting.

If you are a beneficial owner, meaning you hold shares in our Company in “street name” (i.e., through a broker, bank or other nominee), you cannot vote your shares directly and must instead instruct your broker, bank or other nominee on how to vote your shares.

On that date,the Record Date, the Company had 92,333,12392,447,637 shares of Common Stockcommon stock outstanding.

Shareholders are entitled to one vote per share on each matter to be acted upon.

QuorumHow do I vote my shares without attending the 2020 Annual Meeting?

If you are a shareholder of record, you may vote by granting a proxy. Specifically, you may vote:

| • | by internet—you may submit your proxy by going to www.proxyvote.com and following the instructions on how to complete an electronic proxy card. You will need the 16-digit number included on your notice or proxy card in order to vote by internet. |

| • | by telephone—you may submit your proxy by using a touch-tone telephone to dial 1-800-690-6903 and following the recorded instructions. You will need the 16-digit number included on your notice or proxy card in order to vote by telephone. |

| • | by mail—you may vote by mail by requesting a proxy card from us, indicating your vote by completing, signing and dating the |

card where indicated and Vote Required meeting’sby mailing or otherwise returning the card in the envelope that will be provided to you. You should sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity, you must indicate your name and title or capacity.

| • | online—www.virtualshareholdermeeting.com/SJI2020. Follow the instructions on the website to vote your shares. |

If you are a beneficial owner holding your shares in “street name,” you may vote by submitting voting instructions to your bank, broker or other nominee. In most instances, you will be able to do this on the internet, by telephone or by mail as indicated above. Please refer to information from your bank, broker or other nominee on how to submit voting instructions.

What constitutes a quorum?

A quorum is necessary to conduct the business. This means holders of at least a majority of the outstanding shares of Common Stockcommon stock entitled to vote must be present at the meeting, either by proxy or in person. Shareholders elect Directors by a majority vote of all votes cast at the meeting. The other actions proposed herein require the affirmative vote of a majority of the votes cast at the meeting. The vote required to approve any other matter that may be properly brought before the Annual Meeting will be determined in accordance with the New Jersey Business Corporation Act.

Abstentions and broker non-votes“broker non-votes” (as discussed below) will be treated as present to determine a quorum.

In the absence of a quorum, but will not be deemed to be cast and, therefore, will not affect the outcome of anya majority of the shareholder questions. shareholders present or in person by proxy may vote to adjourn the 2020 Annual Meeting from time to time, without notice other than by oral announcement at the meeting, until the time that a quorum is present.

2 | | South Jersey Industries, Inc. - 2020 Proxy Statement |

Proxy Statement Summary

What is a “broker non-vote” and how does it affect voting on each proposal?

A broker non-vote“broker non-vote” occurs when a bank, broker or other nominee holding shares for a beneficial owner in “street name” does not vote on a particular proposal, because the bank, broker or other nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial

owner. See “Proxy Statement Summary—Votes Required for Approval” for a discussion of which proposals do and do not permit discretionary voting by brokers and the effect of a “broker non-vote.”

VotingWhat am I voting on, how many votes are required to approve each proposal, how are votes counted and how does the Board of Proxies and RevocationDirectors recommend I vote?

See “Proxy Statement Summary—Votes Required for Approval” and “Proxy Statement Summary—Voting Matters and the Board’s Recommendation” for this information.

What if I receive more than one notice or proxy card about the same time?

It generally means you hold shares registered in more than one account. To ensure that all your shares are voted, please sign and return each proxy card, or, if you vote by Internet or telephone, vote once for each notice or proxy card you receive.

What will be the result if I submit my proxy card without making specific instructions?

Properly signed proxies received by the Company will be voted at the meeting. If a properly signed proxy contains a specific instruction about any matter to be acted on, the shares represented by the proxy will be voted according to those instructions. IfConversely, if you sign and return your proxy but do not indicate

how to vote for a particular matter, your shares will be voted as the Board of Directors recommends. A shareholder who returns aSee “Proxy Statement Summary—Voting Matters and the Board’s Recommendation” for information on the Board of Directors’ voting recommendations.

May I revoke my proxy may revoke it at any time before it isor change my vote?

Yes. Whether you have voted by submittingInternet, telephone or mail, if you are a later-dated proxy or by voting by ballot at

the meeting. Ifshareholder of record, you attend the meeting and wish tomay revoke your proxy you must notifyor change your vote by:

| • | sending a written statement to that effect to the attention of our Corporate Secretary, 1 South Jersey Plaza, Folsom, New Jersey 08037, provided such statement is received no later than April 23, 2020,or, in the case of voting of shares held through the Company’s 401(k) plan, no later than April 21, 2020; |

| • | submitting a properly signed proxy card with a later date that isreceived no later than April 23, 2020, or, in the case of voting of shares held through the Company’s equity incentive plans, no later than April 21, 2020; or |

If anyyou are a beneficial owner holding your shares in “street name”, you may submit new voting instructions by contacting your bank, broker or other mattersnominee. You may also change your vote or motions properly comerevoke your proxy in person at the 2020 Annual Meeting if you obtain a signed proxy from the record holder (bank, broker or other nominee) giving you the right to vote the shares in person.

What do I need to be admitted to the 2020 Annual Meeting?

See “Proxy Statement Summary—Annual Meeting of Shareholders” for this information.

Where can I find the results of the 2020 Annual Meeting?

We will disclose the final voting results on a current report on Form 8-K within four business days after the 2020 Annual Meeting.

South Jersey Industries, Inc. - 2020 Proxy Statement | | 3 |

Any proposal that a qualified shareholder of the Company wishes to include in the Company’s Proxy Statement and form of proxy for the Company’s 2021 Annual Meeting of Shareholders pursuant to Rule 14a-8 under the Exchange Act must be received by the Company at its principal executive offices by November 13, 2020. To be included, proposals should be mailed to the Corporate Secretary at 1 South Jersey Plaza, Folsom, New Jersey 08037. To be a qualified shareholder, a shareholder must have owned at least $2,000 in market value of the Company’s securities for at least one year before the meeting, including any matters dealingdate of the proposal’s submission to the Company.

Additionally, a shareholder of the Company may wish to nominate a director or have other business presented at the 2021 Annual Meeting of Shareholders, but not to have such proposal included in the Company’s Proxy Statement and form of proxy relating to that meeting. In compliance with the conductCompany’s bylaws, notice of any

such proposal must be received by the Company at its principal executive offices between January 24, 2021 and February 23, 2021. However, if we hold our 2021 Annual Meeting of Shareholders more than 30 days before or after the anniversary date of the 2020 Annual Meeting of Shareholders, such notice must be received by us no later than the tenth day after the date on which we publicly disclose or send notice regarding the date of the meeting (whichever is earlier). All such nominations and other proposals should be mailed to the persons namedCorporate Secretary at 1 South Jersey Plaza, Folsom, New Jersey 08037 and must satisfy the informational requirements set forth in our bylaws. If a nomination or proposal for other business is not received during this period, such proposal shall be deemed “untimely” for purposes of Rule 14a-4(c) under the accompanying proxy card intendExchange Act, and, therefore, the proxies will have the right to voteexercise discretionary voting authority with respect to such proposal.

Other Proposed Action for the proxy according to their judgment. 2020 Annual Meeting of Shareholders

The Board of Directors is not awareknows of any suchno matters other than those describedset forth in this proxy statement.the Notice of Annual Meeting of Shareholders to come before the 2020 Annual Meeting. However, if any other business should properly be presented at the meeting, the proxies will be

voted in accordance with the judgment of the person or persons holding the proxies pursuant to Rule 14a-4(c) under the Exchange Act.

Under rules adopted by the SEC, we are permitted to deliver a single copy of the proxy materials, including the Notice of Annual Meeting of Shareholders, this Proxy Statement and the 2019 Annual Report, to any household at which two or more shareholders reside if we believe the shareholders are members of the same family. This process, called “householding,” allows us to reduce the number of copies of these materials we must print and mail. Even if householding is used, each shareholder will continue to be entitled to submit a separate proxy or voting instructions.

Certain banks, brokers, broker-dealers and other similar organizations acting as nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of this proxy statement and the Company’s 2018 Annual Report may have been sent to multiple shareholders in your household.materials. If you are a beneficial owner of our shares and would prefer to receive separate copies of a proxy statementProxy Statement or annual report for other shareholders in your household, either now or in the future, please

contact your bank, broker, broker-dealer or other similar organization serving as your nominee.

Upon written or oral request to the Corporate Secretary at 1 South Jersey Plaza, Folsom, New Jersey 08037, the Company will promptly provide separate copies Beneficial owners of the 2018 Annual Report and/or this proxy statement. Shareholdersour shares sharing an address who are receiving multiple copies of this proxy statementour Proxy Statement and/or the 2018 Annual Reportour annual report and who wish to receive a single copy of these materials in the future will need to contact their bank, broker, broker-dealer or other similar organization serving as their nominee to request that only a single copy of each document be mailed to all shareholders at the shared address in the future.

General Information

Other Matters

Any proposal that a qualified shareholder of the Company wishesIf you consent to includehouseholding, your election will remain in the Company’s proxy statement to be sent to shareholders in connection with the Company’s 2020 Annual Meeting of Shareholders that is received by the Company after November 16, 2019 will not be eligible for inclusion in the Company’s proxy statement and form of proxy for that meeting. To be included, proposals can be mailedeffect until you revoke it. Upon written or oral request to the Corporate Secretary at 1 South Jersey Plaza, Folsom, New Jersey 08037. To be a qualified shareholder, a shareholder must have owned at least $2,000 in market value of the Company’s securities for at least one year before the date of the proposal’s submission to the Company. A shareholder of08037, the Company may wish to have a proposal presented at the 2020 Annual Meetingwill promptly provide separate copies of Shareholders, but not to have such proposal included in the Company’s proxy statement

and form of proxy relating to that meeting. In compliance with the Company’s bylaws, notice of any such proposal must be received by the Company between January 27, 2020 and February 26, 2020. If it is not received during this period, such proposal shall be deemed “untimely” for purposes of Rule 14a-4(c) under the Exchange Act, and, therefore, the proxies will have the right to exercise discretionary voting authority with respect to such proposal. Any such proposal must be submitted in writing to the Corporate Secretary at the address previously provided in this section.

The Board of Directors knows of no matters other than those set forth in the Notice of Annual Meeting of Shareholders to come before the 2019 Annual Meeting.Report and/or this Proxy Statement.

4 | | South Jersey Industries, Inc. - |

At the Annual Meeting, 10 directors are to be elected to the Board of Directors to hold office for a one-year term. The Board nominated the following persons: Sarah M. Barpoulis, Thomas A. Bracken, Keith S. Campbell, Victor A. Fortkiewicz, Sheila Hartnett-Devlin, WalterG. Edison Holland Jr., Sunita Holzer, Kevin M. Higgins III, Sunita Holzer,O’Dowd, Michael J. Renna, Joseph M. Rigby and Frank L. Sims. We do not anticipate that, if elected, any of the nominees will be unable to serve. If any should be unable to accept the nomination or election, the persons designated as proxies on the proxy card may vote for a substitute nominee selected by the Board of Directors. Current directors, Walter M. Higgins, III and Thomas A. Bracken are not being nominated as nominees to the Board at the Annual Meeting. Mr. Higgins will continue to serve as the non-executive Chairman of SJI’s Board of Directors until his retirement on April 24, 2020. At that time the Board of Directors will elect a new independent non-executive Chairman. The Board is grateful to Mr. Higgins and Mr. Bracken for all they have done for our Company, our shareholders and our employees. Accordingly, after the Annual Meeting the size of our Board will be reduced to 10 members.

In accordance with its Charter, the Governance Committee reviewed the education, experience, judgment, diversity and other applicable and relevant skills of each nominee and determined that

each nominee possesses skills and characteristics that support the Company’s strategic vision. The Governance Committee determined that the key areas of expertise include: corporate governance; cybersecurity/IT; enterprise leadership; environmental, social, governance (ESG); financial expertise (including accounting, finance, and “financial experts” as defined by the SEC); governmental and regulatory; human resources; public/shareholder relations; risk assessment/management; strategy formation/execution; and technical/industry. The Governance Committee concluded that the nominees possess expertise and experience in these areas, and the Board approved the slate of nominees. Based on their expertise and experience, the Board, upon recommendation of the Governance Committee, determined the following directors should be electednominated for re-election to the Board at the Annual Meeting to serve for the 20192020 - 20202021 term:

South Jersey Industries, Inc. - 2020 Proxy Statement | | 5 |

Proposal 1 Director Elections

Highlights of Director Nominees

| Sarah M. Barpoulis |   | |||

Age: | Age: | ||||

Director since:2012 | Director since: | ||||

Owner of Interim Energy Solutions, LLC, Potomac, MD | |||||

|   | Victor A. Fortkiewicz |  | Sheila Hartnett-Devlin, CFA | |

Age: | Age: | ||||

Director since: | Director since: | ||||

Of Counsel, Cullen and Dykman, LLP, New York, NY | Retired, Senior Vice President, American Century Investments, New York, NY | ||||

|   | ||||

Age: | Age: | ||||

Director since: | Director since: | ||||

Retired, | |||||

|   | Michael J. Renna | |||

Age: | Age: | ||||

Director since: | Director since:2014 | ||||

President and CEO, South Jersey Industries, Folsom, NJ | |||||

| Joseph M. Rigby |   | Frank L. Sims |

Age: | Age: | ||

Director since:2016 | Director since:2012 | ||

Retired, Chairman, President and CEO of Pepco Holdings, Inc., Washington, D.C. | Chairman of the Board, Atlanta Pension Fund, Atlanta, GA |

The Board of Directors unanimously recommends a vote “FOR” each of the above nominees.

6 | | South Jersey Industries, Inc. - 2020 Proxy Statement |

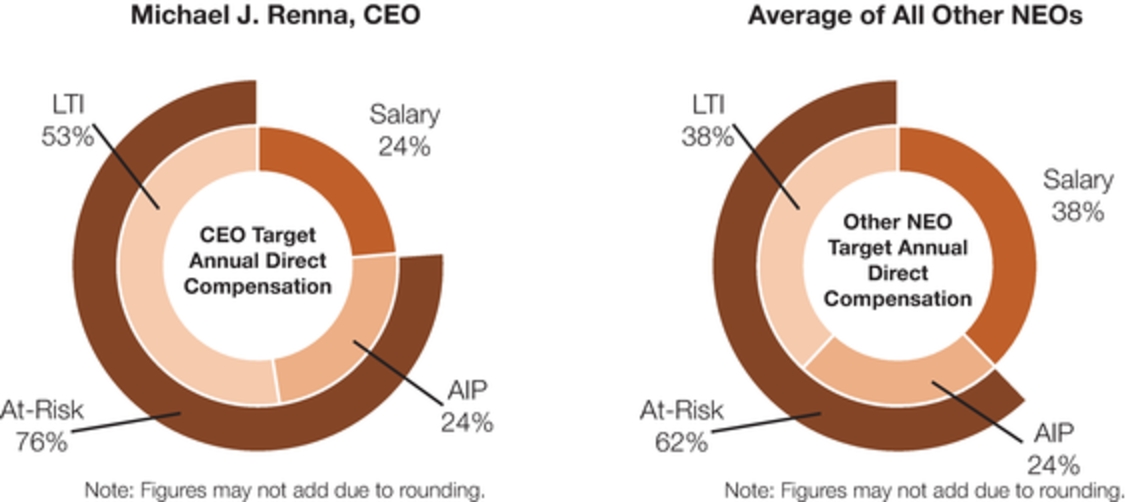

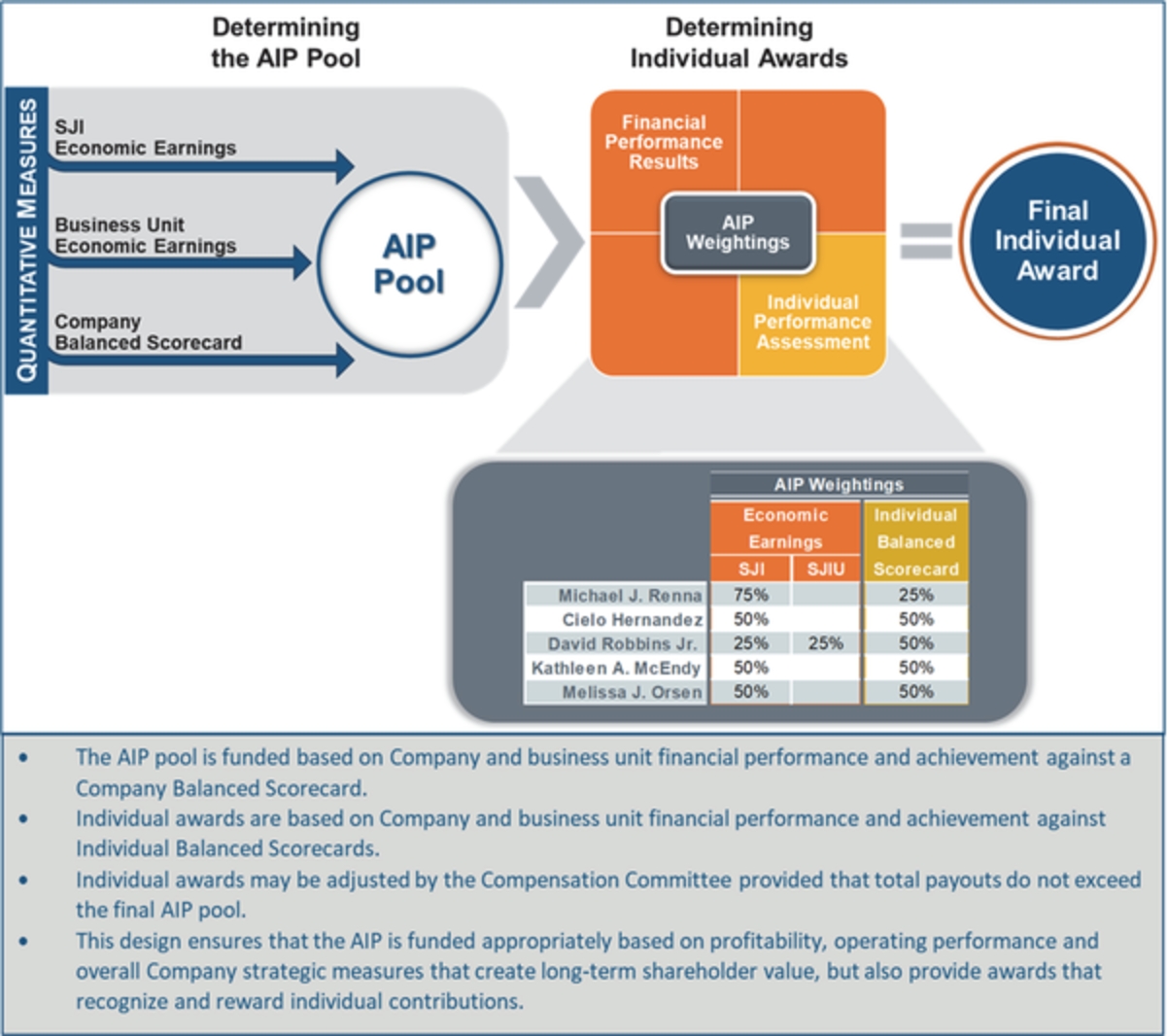

Our executive compensation program is designed to keep our senior leadership team focused on the seamless execution of the Company’s strategic plan and on delivering shareholder value over the long term. During 2019, our senior leadership team achieved critical financial objectives and continued to execute on our Business Transformation Plan by driving forward the strategic initiatives that reinforce our focus on reliable, repeatable earnings that complement regulated growth.

During 2019, we increased the focus and intensity of our shareholder engagement efforts. The Board of Directors reached out to approximately 35 of our largest shareholders, aggregating approximately 66% of our outstanding shares.

Members of the Board, including the Chairman and Compensation Committee Chairman, met with nine of our ten top shareholders, representing approximately 30% of our shares outstanding. Through these efforts, we learned that our investors are highly supportive of our overall program design and its significant emphasis on performance-based pay. However, in response to some common concerns about one-time recognition awards to current NEOs and the notion that the existing connection between pay and performance could be enhanced, we took immediate action — the details of which are outlined in our Compensation Discussion and Analysis (“CD&A”) beginning on page 29 of this Proxy statement.

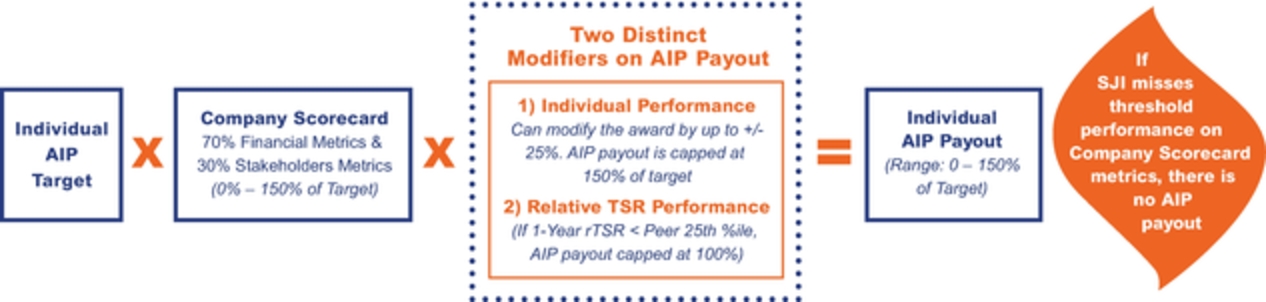

Our compensation philosophy continued to be supported by the following principal pay elements for 2019:

Pay Element | Description | Rationale |

Salary | Fixed cash opportunity | Provides stable market based compensation for role, level of responsibility and experience. Forms basis for other pay elements |

Annual Incentive Plan (“AIP”) | Annual cash compensation with variable payout based on achievement of pre-determined corporate/business unit economic earnings goals and individual balanced scorecard objectives (other strategic non-earnings goals) for the fiscal year | Drives and incentivizes annual performance across key financial and individual performance measures |

Long-Term Incentives (“LTI”) | LTI is granted 70% in performance-based restricted stock units (“PBRSUs”), based on 3-year relative Total Shareholder Return (“TSR”) vs. peers and 3-year economic earnings growth, and 30% in time-based restricted stock units (“TBRSUs”) | PBRSU portion of awards, representing significant majority of total LTI opportunity, requires achievement of threshold level of performance for any payout; Combination of PBRSUs and TBRSUs drives long-term financial performance, shareholder value and executive retention |

We note that pursuant to SEC regulations, the Summary Compensation Table on page 45 shows total compensation for our NEOs, including not only the valuation of the major elements of our program listed above, but also other numbers that we do not consider to be a significant driver of our overall pay philosophy. For example, the Summary Compensation Table includes a column for the change in pension value and nonqualified compensation earnings which is an actuarily determined year over year change in the value of a pension balance and clearly not reflective of Committee thought process and decision making within the scheme of our compensation philosophy. For this reason, we included an additional and separate column in the Summary Compensation Table that reflects total compensation minus the change in pension value and nonqualified compensation earnings for our NEOs. For the following reasons, among others, we believe this number is more representative of actual compensation, as it pertains to the 2017 through 2019 fiscal years:

South Jersey Industries, Inc. - | 7 |

Proposal 2 Advisory Vote To Approve Executive Compensation

The following features of our executive compensation program promote sound compensation governance and are designed in the best interests of our shareholders and executives:

What We Do | What We Don’t Do | ||

✔ | Seventy (70) percent of LTI awards are performance-based for the NEOs | ✘ | No excise tax gross ups |

✔ | Three-year performance periods under our LTI awards | ✘ | No repricing or exchange of equity awards without shareholder approval |

✔ | Use a mix of absolute and relative financial performance metrics (including relative TSR) in the incentive plans, to avoid duplication of incentives across AIP and LTI plans. | ✘ | No employment agreements |

✔ | Caps on incentive awards | ✘ | No hedging or pledging of Company stock for employees or directors |

✔ | Use of ESG Metrics in AIP | ✘ | No tax gross ups for perquisites |

✔ | Change-in-control “double-trigger” for equity award vesting and severance benefits | ||

✔ | Robust claw-back policy applying to all incentive awards | ||

✔ | Limited number of perquisites | ||

✔ | Independent compensation consultant | ||

✔ | Robust stock ownership guidelines | ||

Pursuant to Section 14A(a)(1) of the Exchange Act, SJI is required to provide shareholders with a separate non-binding vote to approve the compensation of our named executive officers, including the CD&A, the compensation tables, and any other narrative disclosure in this Proxy statement. Such a proposal, commonly known as a “say-on-pay” proposal, gives shareholders the opportunity to endorse or not endorse our executive compensation policies and procedures as described in this Proxy statement. Shareholders may also abstain from voting.

Accordingly, shareholders are being asked to approve the following non-binding resolution:

“RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion is hereby APPROVED.”

Because your vote is advisory, it will not be binding on the Board and may not be construed as overruling any decision by the Board. However, the Compensation Committee values the opinions expressed by shareholders and expects to take into account the outcome of the vote when considering future executive compensation decisions.

The Board of Directors unanimously recommends a vote “FOR” the non-binding resolution approving the compensation paid to the named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the CD&A, compensation tables and narrative discussion.

8 | | South Jersey Industries, Inc. - 2020 Proxy Statement |

The Audit Committee is responsible for recommending the appointment of the independent registered public accounting firm to the Board and is directly responsible for the compensation and oversight of the independent auditor.

Annually, prior to making its recommendation, the Audit Committee considers the audit firm’s capabilities, effectiveness, industry experience, and use of technology and data analytics in its audits; knowledge of the Company including its personnel, processes, accounting systems and risk profile; tenure serving the Company; and independence, and other firms with comparable professional qualifications.

Deloitte & Touche LLP (“Deloitte”) is a top accounting firm with expertise in public utility accounting. Deloitte has been the Company’s, or its predecessor Company’s, auditor since 1948 giving it a unique understanding of Company’s businesses and personnel. The Audit Committee considered the impact of tenure on Deloitte’s independence and determined Deloitte remains independent as, among other factors, the lead engagement partner is required to rotate off the Company’s audit every 5 years. The current lead engagement partner will rotate off after the 2023 audit. Further, the Audit Committee pre-approves all audit and non-audit services and related compensation and monitors the potential impact on independence. Finally, the Company has a policy restricting hiring certain persons formerly associated with Deloitte into an accounting or financial reporting oversight role to help ensure Deloitte’s continuing independence.

During 2019, the audit services performed for the Company consisted of (1) audits of the Company’s and its subsidiaries’ financial statements and the effectiveness of the Company’s

internal control over financial reporting, as required by the Sarbanes-Oxley Act of 2002, Section 404 and the preparation of reports based on such audits related to filings with the Securities and Exchange Commission; and (2) services performed in connection with financing transactions.

The Audit Committee evaluates the quality of Deloitte’s services annually, considering the quality of their audit services, industry knowledge from an audit and tax perspective, continued independence, information from PCAOB inspection reports, and the Audit Committee’s discussions with management about Deloitte’s performance.

After considering all factors, the Audit Committee and the Board believe that the continued retention of Deloitte to serve as the Company’s Independent Registered Public Accounting Firm for 2020 is in the best interest of the Company and its shareholders. Although ratification is not required by our bylaws or otherwise, the Board is submitting the selection of Deloitte to our shareholders for ratification because we value the views of our shareholders on the Company’s Independent Registered Public Accounting Firm. If our shareholders fail to ratify the selection of Deloitte, it will be considered notice to the Board and Audit Committee to consider the selection of a different firm. Representatives of Deloitte will be at the meeting to respond to appropriate questions and make a statement if they wish.

The Board of Directors unanimously recommends a vote “FOR” the ratification of the reappointment of Deloitte & Touche LLP, as the Independent Registered Public Accounting Firm.

South Jersey Industries, Inc. - 2020 Proxy Statement | | 9 |

Proposal 1 Director Elections

HIGHLIGHTS OF DIRECTOR NOMINEES

Our Director nominees possess skills and experience aligned to our current and future strategy and business needs. Annual Board evaluations also include an assessment of whether the Board has an appropriate mix of skills, experience and other characteristics.

All Director Nominees Have:

• | A reputation of high integrity | • | |

An ability to exercise sound judgement |

Our Director nominees exhibit an effective mix of diversity, experience and fresh perspective

| South Jersey Industries, Inc. - |

Proposal 1 Director Elections

Our Director nominees exhibit an effective mix of diversity, experience and fresh perspective

South Jersey Industries, Inc. - 2020 Proxy Statement | | 11 |

Proposal 1 Director Elections

The Board of Directors recommends a vote “FOR”

each of the following nominees:

Sarah M. Barpoulis

Age: Director since:2012 Owner of Interim Energy Solutions, LLC, Potomac, MD | Skills and Qualifications: | |

• | Director Barpoulis’ areas of expertise include corporate governance; enterprise leadership; environmental, social, governance (ESG); financial expertise; risk assessment/ | |

• | Director Barpoulis is a financial expert as defined by the | |

• | Director Barpoulis is a National Association of Corporate Directors Board Leadership Fellow. | |

SJI Boards and Committees: | ||

• | Chairman of the Audit Committee | |

• | Compensation Committee | |

• | Executive Committee | |

• | Strategy & Finance Committee | |

Since 2003, Ms. Barpoulis has provided asset management and advisory services to the | ||

Thomas A. Bracken

| ||

Proposal 1 Director Elections

Keith S. Campbell

Age: Director since:2000 Chairman of the Board, Mannington Mills, Inc., Salem, NJ | Skills and Qualifications: | |

• | Director Campbell’s areas of expertise include corporate governance, cybersecurity/IT, enterprise leadership, | |

SJI Boards and Committees: | ||

• | Compensation Committee | |

• | Corporate Responsibility Committee | |

• | Risk Committee | |

Mr. Campbell has served as chairman of the board for Mannington Mills, Inc. since 1995, as director of the Federal Reserve Bank of Philadelphia from 2008 to 2013 and as a director of Skytop Lodge, Inc. from 2000 to 2015. | ||

12 | | South Jersey Industries, Inc. - 2020 Proxy Statement |

Proposal 1 Director Elections

Victor A. Fortkiewicz

Age: Director since:2010 Of Counsel, Cullen and Dykman, LLP, New York, NY | Skills and Qualifications: | |

• | Director Fortkiewicz’ areas of expertise include corporate governance; enterprise leadership; environmental, social, governance | |

SJI Boards and Committees: | ||

• | Chairman of the Corporate Responsibility | |

• | Risk Committee | |

Mr. Fortkiewicz has been Of Counsel, Cullen and Dykman, LLP since October 2011. He served as executive director, New Jersey Board of Public Utilities from 2005 to 2010. | ||

Sheila Hartnett-Devlin, CFA

Age: Director since: 1999 Retired, Senior Vice President, American Century Investments, New York, NY | Skills and Qualifications: | |

• | Director Hartnett-Devlin’s areas of expertise and experience include corporate governance; enterprise leadership; environmental, social, governance | |

• | Director Hartnett-Devlin is a financial expert as defined by the SEC. | |

SJI Boards and Committees: | ||

• | Audit Committee | |

• | Governance Committee | |

• | Strategy & Finance Committee | |

• | ||

Executive Committee member, SJI Midstream, LLC; South Jersey Energy Solutions, LLC | ||

Ms. Hartnett-Devlin serves as a member of the board of Mannington Mills, Inc. Ms. Hartnett-Devlin formerly served as senior vice president, American Century Investments. She is a member of the NY Society of Security Analysts. | ||

13 |

Proposal 1 Director Elections

Walter M. Higgins IIIG. Edison Holland, Jr.

Age: Director since: Retired, EVP Southern Company Services, | Skills and Qualifications: | |

• | Director | |

SJI Boards and Committees: | ||

• | ||

• | ||

• | ||

Mr. | ||

Sunita Holzer

Age: Director since: 2011 Executive Vice President, Chief Human Resource Officer, Realogy Holdings Corp., Madison, NJ | Skills and Qualifications: | |

• | Director Holzer’s areas of expertise include corporate governance, enterprise leadership, | |

SJI Boards and Committees: | ||

• | Chairman of the Compensation Committee | |

• | Corporate Responsibility Committee | |

• | Executive Committee | |

• | Risk Committee | |

Ms. Holzer has served as Executive Vice President, Chief Human Resource Officer, Realogy Holdings Corp. since March 2015; served as president, Human Capital Insight, LLC from June 2014 to February 2015; served as executive vice president and chief human resources officer, CSC, from June 2012 to May 2014; and served as executive vice president, chief human resources officer, Chubb Insurance Company from 2003 to June 2012. Ms. Holzer is formerly an advisory board member of Re: Gender. Ms. Holzer serves on the Human Resource Management Department Advisory Board at Rutgers School of Management and Labor Relations. She speaks and writes regularly about human resource management and leadership issues and is the author of Wednesday Wisdom, a weekly LinkedIn blog. She is a past member of the board for Jersey Battered Women’s Service and in 2009 was recognized as a Woman Who Makes a Difference by the National Organization for Research on Women. | ||

14 | | South Jersey Industries, Inc. - |

Proposal 1 Director Elections

Kevin M. O’Dowd

Age: 47 Director since: 2020 Co-President/CEO of Cooper University Health Care, Camden, NJ | Skills and Qualifications: | |

• | Director O’Dowd’s areas of expertise include cybersecurity/IT; enterprise leadership; environmental, social, governance (ESG); governmental and regulatory; human resources; and strategy formation/execution. | |

SJI Boards and Committees: | ||

Mr. O’Dowd currently serves as the Co-President/CEO of Cooper University Health Care. Mr. O’Dowd joined Cooper University Health Care in 2015 as Senior Executive Vice President/Chief Administrative Officer and served in that position until 2018. Before joining Cooper, Mr. O’Dowd served in the Cabinet of New Jersey Governor Chris Christie, including as Chief of Staff from 2012 to 2014. Mr. O’Dowd also served as a federal prosecutor in the U.S. Attorney’s Office for the District of New Jersey from 2003-2010 most recently as Chief of the Securities and Healthcare Fraud Unit, prior to that he served as a Deputy Attorney General for the State of New Jersey. Mr. O’Dowd holds a Juris Doctor from St. John’s University School of Law. | ||

Michael J. Renna

Age: Director since: 2014 President and CEO, South Jersey Industries, Folsom, NJ | Skills and Qualifications: | |

• | Director Renna’s areas of expertise include enterprise leadership, financial expertise, governmental and regulatory, human resources, risk assessment/management, strategy formation/execution and technical/industry. | |

SJI Boards and Committees: | ||

• | Chairman of the Board, Energy & Minerals, Inc. | |

• | Chairman of the Board, R&T Group, Inc. | |

• | Chairman of the Board, South Jersey Energy Company | |

• | Chairman of the Executive Committee, | |

Mr. Renna has been President and Chief Executive Officer of South Jersey Industries, Inc. since May 1, 2015. | ||

South Jersey Industries, Inc. - 2020 Proxy Statement | | 15 |

Proposal 1 Director Elections

Joseph M. Rigby

Age: Director since:2016 Retired, Chairman, President and CEO of Pepco Holdings, Inc., Washington, D.C | Skills and Qualifications: | |

• | Director Rigby’s areas of expertise include corporate governance, cyber | |

• | Director Rigby is a financial expert as defined by the SEC. | |

SJI Boards and Committees: | ||

• | Audit Committee | |

• | Compensation Committee | |

• | Chairman of the Strategy & Finance Committee | |

• | Director of SJI Utilities, Inc.; South Jersey Gas Company; Elizabethtown Gas Company; and Elkton Gas Company | |

Mr. Rigby served as | ||

Proposal 1 Director Elections

Frank L. Sims

Age: Director since: 2012 Chairman of the Board, Atlanta Pension Fund, Atlanta, GA | Skills and Qualifications: | |

• | Director Sims’ areas of expertise include corporate governance, enterprise leadership, financial expertise, human resources, risk assessment/management, and | |

• | Director Sims is a financial expert as defined by the SEC. | |

SJI Boards and Committees: | ||

• | Audit Committee | |

• | Governance Committee | |

• | Executive Committee | |

• | Chairman of the Risk Committee | |

Mr. Sims currently serves as the Chairman of the Board for the Atlanta Pension Fund. He has served as the Corporate Vice President and Platform Leader at Cargill, Inc. from 2002 to 2007. He also served as | ||

The Board of Directors unanimously recommends a vote “FOR” each of the above nominees.

The Company’s executive compensation policies and procedures are designed to attract and retain highly qualified named executive officers while linking Company performance to named executive officer compensation. The Compensation Committee has a strong pay for performance philosophy; and, as a result, the compensation paid to our named executive officers is designed to be aligned with the Company’s performance on both a short-term and a long-term basis. Our recent performance provides evidence that our executive compensation policies and procedures were effective in furthering these objectives. The financial performance in 2018 for SJI corporate results was at maximum, and therefore, the portion of the annual incentive plan payouts tied to SJI results was earned at maximum. After considering overall Company performance, including the Company’s stock price performance, the Committee applied negative discretion to the final total AIP payout for the CEO and all but one of the NEOs. SJI’s recent stock performance has been below our peer group, and our long-term incentive plans for the performance cycle ended fiscal 2017 paid out well below target. Historically, our financial performance in 2015 was below threshold goals, resulting in annual incentive payouts well below target, while our financial performance in fiscal 2016 exceeded target goals, resulting in payouts above target. Further, our long-term incentive plan for the performance cycle ended fiscal 2015 did not pay out, while the performance cycle ended fiscal 2016 paid out well below target.

For 2018, the executive compensation policies and procedures for our named executive officers consisted of three parts: base salary, annual incentive awards and long-term incentive compensation. The annual incentive awards and long-term incentive compensation were again directly linked to the achievement of predefined short-term and long-term performance as follows:

These components of compensation for SJI’s named executive officers provide the proper incentives to align compensation with

the Company’s performance while enhancing shareholder value. Specifically, if the Company’s performance results meet or exceed pre-established performance targets, named executive officers have an opportunity to realize significant additional compensation through annual incentive awards and long-term equity awards. In addition, the Company’s stock ownership guidelines require our named executive officers to own shares of Company stock, which aligns with shareholder interests. We believe this pay for performance philosophy is integral to the Company’s performance and will drive shareholder value over the long term.

Please see the “Compensation Discussion and Analysis” beginning on page 25 of this Proxy statement for a more detailed discussion of executive compensation policies and procedures for our named executive officers.

Pursuant to Section 14A(a)(1) of the Exchange Act, SJI is required to provide shareholders with a separate non-binding shareholder vote to approve the compensation of our named executive officers, including the “Compensation Discussion and Analysis”, the compensation tables, and any other narrative disclosure in this Proxy statement. Such a proposal, commonly known as a “say-on-pay” proposal, gives shareholders the opportunity to endorse or not endorse our executive compensation policies and procedures as described in this Proxy statement. Shareholders may also abstain from voting.

Accordingly, shareholders are being asked to approve the following non-binding resolution:

“RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion is hereby APPROVED.”

Because your vote is advisory, it will not be binding on the Board and may not be construed as overruling any decision by the Board. However, the Compensation Committee values the opinions expressed by shareholders and expects to take into account the outcome of the vote when considering future executive compensation decisions.

The Board of Directors unanimously recommends a vote “FOR” the non-binding resolution approving the compensation paid to the named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion.

| South Jersey Industries, Inc. - |

The Audit Committee and the Board of Directors, subject to the approval of the shareholders, reappointed Deloitte & Touche LLP, as the Company’s independent registered public accounting firm for 2019. Unless otherwise directed, proxies will be voted “FOR” approval of this appointment. If the shareholders do not ratify this appointment by the affirmative vote of a majority of the votes cast at the meeting, other auditors will be considered by the Audit Committee.

Deloitte & Touche LLP served as the Company’s independent registered public accounting firm during 2018. During 2018, the audit services performed for the Company consisted of audits of the Company’s and its subsidiaries’ financial statements and attestation of management’s assessment of internal control, as required by the Sarbanes-Oxley Act of 2002, Section 404

and the preparation of various reports based on those audits, services related to filings with the Securities and Exchange Commission and the New York Stock Exchange, and audits of employee benefit plans as required by the Employee Retirement Income Security Act. A representative of Deloitte & Touche LLP is expected to be present at the Annual Meeting and will have the opportunity to make a statement, if such representative desires to do so, and to respond to appropriate questions from shareholders.

The Board of Directors unanimously recommends a vote “FOR” the ratification of the reappointment of Deloitte & Touche LLP, as the Independent Registered Public Accounting Firm.

The following table sets forth certain information with respect to the beneficial ownership of our common stock, as of February 25, 2019,24, 2020, of: (a) each current director and nominee for director; (b) our principal executive officer, principal financial officer, the three other

most highly compensated executive officers during 20182019 collectively, the “Named Executive Officers” (NEOs); and (c) all of the directors and executive officers as a group.

Number of Shares of Common Stock (1) | Percent of Class | Number of Shares of Common Stock (1) | Percent of Class | |||||||||||

Sarah M. Barpoulis | 24,873 | (2 | ) | * | 28,965 | (2 | ) | * | ||||||

Thomas A. Bracken | 61,101 | (2 | ) | * | 65,675 | (2 | ) | * | ||||||

Keith S. Campbell | 54,148 | (2 | ) | * | 59,254 | (2 | ) | * | ||||||

Stephen H. Clark | 35,405 | * | ||||||||||||

Victor A. Fortkiewicz | 33,645 | (2 | ) | * | 37,702 | (2 | ) | * | ||||||

Sheila Hartnett-Devlin | 22,458 | (2 | ) | * | 26,546 | (2 | ) | * | ||||||

Cielo Hernandez | 0 | (3 | ) | * | 2,392 | (3 | ) | * | ||||||

Walter M. Higgins III | 42,520 | (2 | ) | * | 47,940 | (2 | ) | * | ||||||

Sunita Holzer | 29,482 | (2 | ) | * | 33,685 | (2 | ) | * | ||||||

Kenneth Lynch | 11,664 | * | ||||||||||||

G. Edison Holland, Jr. | 4,214 | (2 | ) | * | ||||||||||

Kenneth A. Lynch | 16,928 | * | ||||||||||||

Kathleen A. McEndy | 15,021 | * | 25,377 | (3 | ) | * | ||||||||

Kevin M. O’Dowd | 2,863 | (2 | ) | * | ||||||||||

Melissa J. Orsen | 0 | * | 2,029 | (3 | ) | * | ||||||||

Michael J. Renna | 87,595 | * | 120,560 | (3 | ) | * | ||||||||

Joseph M. Rigby | 11,770 | (2 | ) | * | 15,466 | (2 | ) | * | ||||||

David Robbins, Jr. | 34,364 | * | 43,557 | (3 | ) | * | ||||||||

Frank L. Sims | 82,658 | (2 | ) | * | 86,745 | (2 | ) | * | ||||||

All directors, nominees for director and executive officers as a group (16 persons) | 546,704 | |||||||||||||

All directors, nominees for director and executive officers as a group (17 persons) | 619,898 | |||||||||||||

* Less than 1%.

| (1) | Based on information furnished by the Company’s directors and executive officers. Unless otherwise indicated, each person has sole voting and dispositive power with respect to the Common Stock shown as owned by him or her. |

| (2) | Includes shares awarded to each director under a Restricted Stock Program for directors. Per the Restricted Stock Agreements, directors do not have voting rights on restricted stock awards. |

| (3) |

17 |

Security Ownership

The Board of Directors believes significant ownership of Company Common Stockcommon stock better aligns the interests of management with those of the Company’s shareholders. Therefore, in 2001, the Board of Directors enacted the stock requirements listed below for officers which were effective through 2014 and were increased effective 2015 as outlined below and on page 38:43:

As of December 31, 2018,2019, the CEO and all NEOs are in compliance with the ownership guidelines.

plan for purposes of determining compliance with the stock ownership requirement for officers. Current officers will have a

period of six years fromIn November 2019, the original date of adoption and newly elected or promoted officers will have a period of six years following their election or promotion to a new position as an officer to meet these minimum stock ownership requirements; andrequirements was eliminated. All officers of the Company are required to retain at least 50 percent of vested and/or earned shares, net of taxes, until their new stock ownership guideline have been met.

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors and executive officers to file reports with the SEC relating to their ownership of, and transactions in, the Company’s Common Stock. Based on our records and other information, the Company believes that all Section 16(a) filing requirements were met for the year ended December 31, 2018, except for a late filing by each of Ms. McEndy, Ms. Orsen and2019,

Messrs. Renna, Clark, Robbins and Lynch who inadvertently filed a lateexcept for Form 4 filed by Mr. Robbins on March 5,June 10, 2019 reporting two late transactions, the grantsale of 35 shares that occurred on May 13, 2019 and the forfeiture of shares to cover tax withholdings in connection with the vesting of Performance Restricted Stock Units that occurred on March 1, 2018; and for a late filing by each of Ms. McEndy and Mr. Robbins who inadvertently filed a later Form 4 on March 5, 2019 reporting the grant of Restricted Stock Units that occurred on June 7, 2018.2019.

The following table sets forth certain information, as of February 25, 2019,24, 2020, as to each person known to the Company, based on filings with the SEC, who beneficially owns 5 percent or more of the

Company’s Common Stock.common stock. Based on filings made with the SEC, each shareholder named below has sole voting and investment power with respect to such shares.

Name and Address of Beneficial Owner | Shares Beneficially Owned | Percent of Class | Shares Beneficially Owned | Percent of Class | ||||

BlackRock, Inc. 55 East 52nd Street New York, NY 10055 | 12,765,638 | 14.9% | 14,260,418 | 15.5.% | ||||

The Vanguard Group 100 Vanguard Blvd Malvern, PA 19355 | 9,293,313 | 10.86% | 10,501,841 | 11.4% | ||||

Macquarie Investment Management Business Trust 2005 Market Street Philadelphia, PA 19103 | 4,809,229 | 5.2% | ||||||

18 | | South Jersey Industries, Inc. - |

Effective May 1, 2015, the Board of Directors decided to separate the Chairman and CEO roles, with Mr. Renna assuming the role of President and CEO, and Walter M. Higgins III, becoming the non-executive Chairman of SJI’s Board of Directors. Mr. Higgins will continue to serve as the non-executive Chairman of SJI’s Board of Directors until his retirement on April 24, 2020. At that time the Board of Directors will elect a new independent non-executive Chairman.

InThe non-executive Chairman of SJI’s Board of Directors performs the role, Mr. Higgins:following roles:

The Board adopted Corporate Governance Guidelines that require the Board to be composed of a majority of Directors who are “Independent Directors” as defined by the rules of the New York Stock Exchange. No Director will be considered “Independent” unless the Board of Directors affirmatively determines that the Director has no material relationship with the Company. When making “Independence” determinations, the Board considers all relevant facts and circumstances, as well as any other facts and considerations specified by the New York Stock Exchange, by law or by any rule or regulation of any other regulatory body or self-regulatory body applicable to the Company. As part of its

Corporate Governance Guidelines, the Board established a policy that Board members may not serve on more than four other boards

of publicly traded companies. SJI’s Corporate Governance Guidelines are available on our website at www.sjindustries.com under the heading “Investors”.

For 2018,2019, the Board determined that Directors Barpoulis, Bracken, Campbell, Fortkiewicz, Hartnett-Devlin, Higgins, Holzer, Rigby, and Sims, constitutinghas all of the non-employeeits current Directors, meet the New York Stock Exchange standards and our own standards noted above for independence and are, therefore, considered to be Independent Directors. Accordingly, all but one of the Company’s Directors was considered to be “Independent.”other than Mr. Renna who is not considered independent by virtue of his employment with the Company.

Mr. Campbell is Chairman of Mannington Mills, Inc., which purchases natural gas from Company subsidiaries. Commencing January 2004, as a result of winning a competitive bid, another Company subsidiary operates a cogeneration facility that provides electricity to Mannington Mills, Inc. Payments made to our Company’s subsidiary by Mannington Mills, Inc. were less than 1% of each of Mannington Mills, Inc. and the Company’s annual consolidated gross revenues during the last completed fiscal year.

Mr. Fortkiewicz is Of Counselof counsel at Cullen and Dykman, LLP, whicha law firm that provides legal representation to SJI

our subsidiary Elizabethtown Gas Company. This is an arm’s length long standing relationship that has existed since 1986 prior to our acquisition of

Elizabethtown Gas Company in July 2018. Mr. Fortkiewicz is not a partner, officer or employee of Cullen and Dykman LLP and he does not provide legal services on any matters relating to Elizabethtown Gas Company.Company, and he did not receive any compensation as a result of the firm’s representation. Payments made by the Company to Cullen and Dykman LLP were less than 1% of Cullen and Dykman LLP’s annual consolidated gross revenues during its last completed fiscal year. Mr. Fortkiewicz does not serve on our Audit, Compensation or Governance committees of the Board even though he is independent under the NYSE listing standards.

South Jersey Industries, Inc. - 2020 Proxy Statement | | 19 |

Corporate Governance

The Company has adopted codes of conductConduct for all employees, Officers and Directors, which include the codesand a Code of ethicsEthics for our principal executive officer and principal financial officer within the meaning of the SEC regulations adopted pursuant to the Sarbanes-Oxley Act of 2002.2002 (collectively the “Codes”). Additionally, the Company established a hotline and website for employees to anonymously report suspected violations.

Copies of the codes of ethicsCodes are available on the Company’s website at www.sjindustries.com under Investors > Corporate Governance. Copies of our codes of conductCodes are also available at no cost to any

shareholder who requests them in writing at South Jersey Industries, Inc., 1 South Jersey Plaza, Folsom, New Jersey 08037, Attention: Corporate Secretary. If the Company were to ever amend or waive any provision of its Code of Ethics that applies to the Company’s principal executive officer, principal financial officer, principal accounting officer or any person performing similar functions, the Company intends to satisfy its disclosure obligations, if any, with respect to any such waiver or amendment by posting such information on its website set forth above rather than by filing a Current Report on Form 8-K.

Corporate Governance

Communication with Directors

You may communicate with the Chairman of the Board and chairmen of the Audit, Compensation, Corporate Responsibility Governance, Risk and Strategy & Finance Committees by sending an e-mail to chairmanoftheboard@sjindustries.com, auditchair@sjindustries.com, compchair@sjindustries.com, govchair@sjindustries.com, corpresp@sjindustries.com, StratandFinChair@sjindustries.com or riskchair@sjindustries.com respectively, or you may communicate with our outsidenon-employee

Independent Directors as a group by sending an e-mail to sjidirectors@sjindustries.com. The Charters and scope of responsibility for each of the Company’s committees are located on the Company’s website at www.sjindustries.com. You may also address any correspondence to the Chairman of the Board, chairmen of the committees or to the Independentnon-employee Directors at South Jersey Industries, Inc., 1 South Jersey Plaza, Folsom, New Jersey 0803708037.

Shareholders can see the Company’s Corporate Governance Guidelines and Profile, Charters of the Audit Committee, Compensation Committee, Corporate Responsibility Committee, Executive Committee, Governance Committee, Risk Committee, and Strategy & Finance Committee, and Codes of Ethics on the Company’s website at www.sjindustries.com under Investors >

Investors>Corporate Governance. Copies of these documents, as well as additional copies of this Proxy Statement, are available to shareholders without charge upon request to the Corporate Secretary at South Jersey Industries, Inc., 1 South Jersey Plaza, Folsom, New Jersey 08037.

The Governance Committee is responsible for implementingimplements the Board Evaluation Process on an annual basis as a method of evaluating the effectiveness of the Board and Committees and to identify opportunities for Board enhancement. The 360° Third-Party Board Effectiveness Evaluation is conducted on an annual basis. The Governance Committee engages an independent, third-party facilitator and uses surveys and interviews to ensure robust feedback. The third-party facilitator is reevaluated periodically to ensure that the feedback that can be used to enhance Board processes.remains robust. The goal of the process is to gather anonymous input from Directors regarding Board composition and processes, and compliance with corporate governance best practices. Covered areas include essential aspects of Board leadershipthe performance and effectiveness of

the Board, the Board Committees, and individual Directors by evaluating the contribution of individual directors, overall group dynamics,Board and whether the experienceCommittee culture, Committee roles and skillsetsresponsibilities and an evaluation of the alignment of members are well alignedskill sets with SJI’s current and future strategic needs. In 2018,The Executive Team participates in the process includedassessment and interview process. Following the evaluationassessment, the Governance Committee and the Chairman of the Board and its committees. In addition to the Directors, the Executive Officers participated in the process. The Governance Committee isare responsible for implementing the recommendations generated from the evaluation results.

Meetings of the Board of Directors and its Committees

|  |  |  |  |  |

The Board of Directors met | Each Director attended 75 percent or more of the total number of Board meetings and the Board committee meetings on which he or she | Each Director attended the 2019 Annual Meeting of Shareholders | It is the Board’s policy that the Independent Directors meet in Executive Session at every in-person meeting of the Board or its Committees. | During | Topics of these Full Board sessions included CEO and Officer Performance and Compensation, Succession Planning, Director Tenure, Retirement Age, Strategy and Discussions of Corporate Governance. Director Higgins, Chairman of the Board, chaired the meetings of the Independent Directors. |

20 | | South Jersey Industries, Inc. - 2020 Proxy Statement |

Corporate Governance

Corporate Governance

Age | Director Since | Audit Committee | Compensation Committee | Corporate Responsibility Committee | Executive Committee | Governance Committee | Risk Committee | Strategy & Finance Committee | |||||

Sarah Barpoulis | 55 | 2012 | Xc | X | X | X | |||||||

Thomas Bracken | 72 | 2004 | X | X | Xc | X | |||||||

Keith Campbell | 65 | 2000 | X | X | X | ||||||||

Victor Fortkiewicz | 68 | 2010 | Xc | X | |||||||||

Sheila Hartnett-Devlin | 61 | 1999 | X | X | X | ||||||||

Walter M. Higgins* | 75 | 2008 | |||||||||||

G. Edison Holland, Jr. | 66 | 2019 | X | X | X | ||||||||

Sunita Holzer | 58 | 2011 | Xc | X | X | X | |||||||

Kevin M. O’Dowd** | 47 | 2020 | |||||||||||

Michael Renna | 52 | 2014 | X | ||||||||||

Joseph Rigby | 63 | 2016 | X | X | Xc | ||||||||

Frank Sims | 69 | 2012 | X | X | X | Xc | |||||||

| c | Committee chaiman |

| * | Walter Higgins is and will continue to serve as an ex-officio member of the each of the Board Committees until his retirement on April 24, 2020. At that time the Board of Directors will elect a new independent non-executive Chairman who will also be appointed as an ex-officio member of the Committee. |

| ** | The Company expects that Mr. O’Dowd will be appointed to committees by the Board following the Company’s 2020 Annual Meeting of shareholders. |

The Board’s Audit Committee, which met eight times during 2018, was2019, is comprised of five “Independent” Directors: Sarah M. Barpoulis, ChairmanChairman; Sheila Hartnett-Devlin; G. Edison Holland, Jr. appointed as of September 12, 2019; Joseph M. Rigby; and Frank L. Sims. Walter M. Higgins III isserves as an ex-officio member of the Committee. The Board determined that no member of the Audit Committee has a material relationship that would jeopardize such member’s ability to exercise independent judgment. The Board of Directors designated each member of the Audit Committee as an “audit committee financial expert” as defined by applicable Securities and Exchange Commission rules and regulations. The Audit Committee: (1) annually engages and evaluates an independent registered public accounting firm for appointment, subject to Board approval and shareholder approval,ratification, as auditors of the Company and has the authority to unilaterally retain, compensate and terminate the Company’s independent registered public accounting firm; (2) reviews with the independent registered public accounting firm the scope and results of each annual audit; (3) reviews with the independent registered public accounting firm, the Company’s internal auditors and management, the quality and adequacy of the Company’s internal controls and the internal audit function’s organization, responsibilities, budget, and staffing; and (4)

(4) establishes policies and procedures for engaging the independent registered public accounting firm to provide audit and permitted non-audit services and (5) considers the possible effect on the objectivity and independence of the independent registered public accounting firm of any non-audit services to be rendered to the Company. The Audit Committee members meet in Executive Session with Internal Audit and the independent accounting firm at each in-person meeting.

The Audit Committee is also responsible for reviewing the Company’s major financial risk exposures and the steps Management has taken to monitor and control these exposures and reviewing the guidelines and policies that govern the process by which risk assessment and management is undertaken by the Board and Management.

The Audit Committee established policiesmembers meet in Executive Session with Internal Audit and procedures for engaging the independent registered public accounting firm to provide audit and permitted non-audit services.at each in-person meeting.

The Committee Charter is available on our website at www.sjindustries.com, under the heading “Investors”. You may obtain a copy by writing to the Corporate Secretary, South Jersey Industries Board of Directors, South Jersey Industries, Inc., 1 South Jersey Plaza, Folsom, New Jersey 08037.

Corporate Governance

Compensation Committee

The Board’s Compensation Committee, which met seven times during 2018, was2019, is comprised of five “Independent” Directors in 2018:the following directors who are independent under SEC and NYSE rules: Sunita Holzer, Chairman; Sarah M. Barpoulis; Keith S. Campbell; and Joseph M. Rigby. Walter M. Higgins III isserves as an ex-officio member of the Committee. Each member of the Compensation Committee met the enhanced independence standards under NYSE rules for committee membership. The Compensation Committee carries out the responsibilities delegated by the Board relating to the review and determination of executive

determination of executive compensation as well as the structure and performance of significant, long-term employee defined benefits and defined contribution plans.

The Committee’s Charter is available on our website at www.sjindustries.com under the heading “Investors” or you may obtain a copy by writing to the Corporate Secretary, South Jersey Industries Board of Directors, South Jersey Industries, Inc., 1 South Jersey Plaza, Folsom, New Jersey 08037.

South Jersey Industries, Inc. - 2020 Proxy Statement | | 21 |

Corporate Governance

No member of the Compensation Committee has ever been an Officer or employee of the Company, or any of its subsidiaries or affiliates. During the last fiscal year, none of the Company’s

Executive Officers served on a compensation committee or as a Director for any other publicly traded company.

The Board’s Corporate Responsibility Committee, which met four times during 2018, was2019, is comprised of five “Independent” Directors: Victor A. Fortkiewicz, Chairman; Thomas A. Bracken; Keith S. Campbell; and Sunita Holzer. Walter M. Higgins III isserves as an ex-officio member of the Committee. The Committee provides oversight, monitoring and guidance of environmental and social related matters related toincluding safety, corporate and social citizenship, public and legal policy, work force initiatives, corporate culture, environmental stewardship and compliance, political and regulatory activities, sustainability, employee work life, and economic and social vitality in the communities and markets in which the Company operates.

The Committee also oversees the production of the Company’s annual Corporate SustainabilityEnvironmental, Social and Governance (ESG) Report, which conveys how the Company links the business with sustainable practices. The ESG at report is available on https://www.sjindustries.com/esg/Home.

Management presents an update of the Company’s Environmental, Social and Governance (ESG) activities at each Corporate

Responsibility Committee meeting. In 2018, reporta board appointed ESG management Committee was created to develop and implement the Company’s key ESG and corporate social responsibility strategies, initiatives and policies and to assist the Board in its oversight, monitoring and guidance of SJI’s key environmental, social and sustainability areas. This includes oversight of SJI’s commitment to safety, environmental, health, human rights, employee relations, governance and community support strategies. The ESG Committee includes cross-functional members of management from key areas of the Company such as human resources, legal, risk management, communications, safety, and environment.

The Corporate Responsibility Committee’s Charter is available on our website at www.sjindustries.com under the heading “Investors” or you may obtain a copy by writing to the Corporate Secretary, South Jersey Industries Board of Directors, South Jersey Industries, Inc., 1 South Jersey Plaza, Folsom, New Jersey 08037.

The Board’s Executive Committee meeting, management presents an updateis comprised of the Company’s Environmental, SocialChairman of the Board, the CEO and the Chairs of the Audit, Compensation, Governance and Risk Committees. The Executive Committee acts as directed by or on behalf of the Board of Directors during intervals between the meetings of the Board of Directors in the event a quorum of the Board is not available and, if at the discretion of the Chairman of the Board, immediate action is needed. The Committee also: reviews and investigates other matters as directed by the Board of Directors; reviews and recommends to the Board the organizational structure of the Company; reviews and recommends to the Board the Officers of the Company and its direct subsidiaries; reviews and recommends to the Board the